Web Content Display

Web Content Display

Debt Disability insurance

What is Debt Disability insurance?

Your creditors expect payment, even when you are disabled. If you are unable to work due to accident or illness, HuGO Debt Disability Insurance pays your monthly obligations on your behalf.

- House or condo (loans or home equity lines of credit, including school and property taxes)

- Rent

- Vehicle loans or leases (cars, boats, motorcycles or other recreational vehicles)

- Credit card and lines of credit

- Leverage loans

Why Debt Disability Insurance?

Debt disability insurance is a flexible and affordable alternative to financial institutions products.

- Tailored to your needs

- Keep your contract even if you change financial institutions or financing modes

- Covers more than one loan or more than one financial institution

- Receive full benefits – even if you receive Group Insurance or government benefits

- Choose to have benefits payable directly to the creditor or deposited into your account

For more information on debt disability insurance please contact your financial advisor.

Things to consider

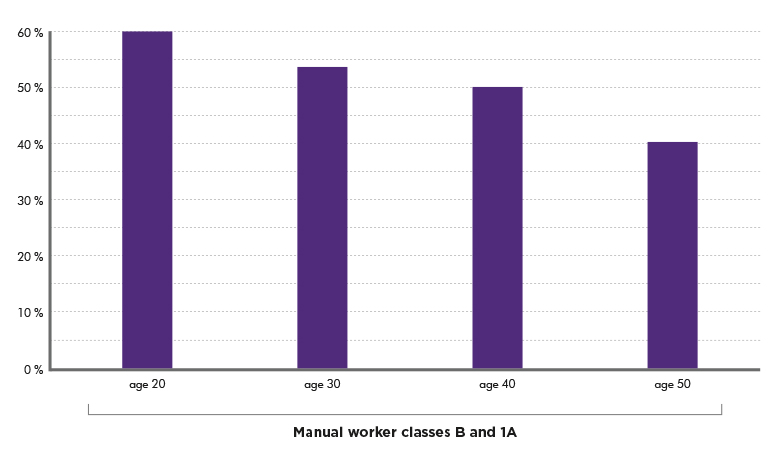

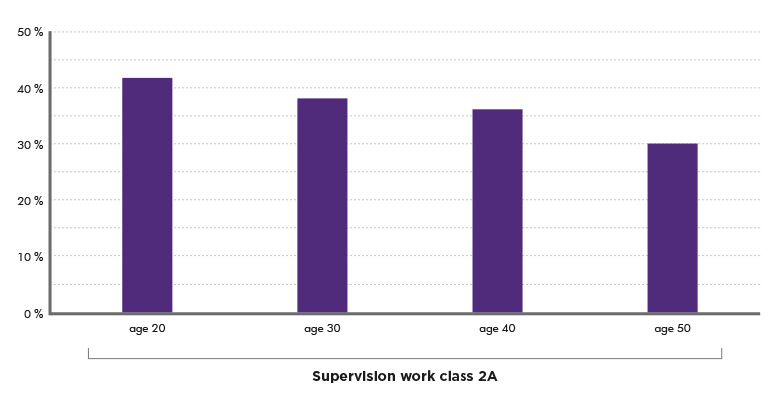

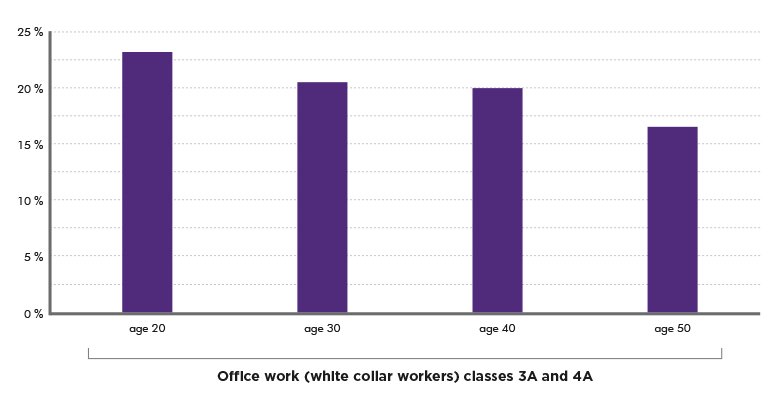

Probability of having a disability during 90 days or more at least once before age 65.

Source: Commissioners Individual Disability Table A (CIDA 85). Data on male smoker and non-smoker.

Source: Commissioners Individual Disability Table A (CIDA 85). Data on male smoker and non-smoker.