Web Content Display

Web Content Display

Critical Illness Insurance

What is Critical Illness Insurance?

"You need insurance not only because you will die, but mostly because you will survive."

Quote from Marius BarnardMarius Barnard was a South African cardiac surgeon and inventor of critical illness insurance. He convinced insurance companies to introduce a new type of insurance to cover critical illnesses after seeing first-hand the financial hardship his patients suffered after he had treated their critical illnesses. Critical illness pays, following the survival period, a tax-free lump sum when you develop one of the 25 critical illnesses.

Why Critical Illness Insurance?

With continuing advancement in diagnosis and treatment ability, we are surviving serious illnesses more often and living longer than ever before. Not all illnesses have the same impact, but all have the potential to create unexpected expenses. A lump-sum cash benefit would allow you to lighten the financial stress associated with your illness.

Focus on your recovery, not your finances.

Possible uses for a lump-sum Critical Illness insurance benefit:

- Income replacement for you, your spouse or family member

- Having someone accompany you while receiving treatment

- Transportation to and parking at the hospital or treatment centre

- Hiring help around the house (housekeeper, yard maintenance, guardian, etc)

- Payment for drugs not covered through provincial plans

- Access to care in the private sector

Teladoc Medical Experts : Enhanced Assistance Program

Teladoc Medical Experts Assistance Program provides benefits for your entire family at no additional cost. Access to the best experts and medical care around the world is at your fingertips.

- Find a Doctor

- Care Finder

- Personal Health Navigator

- Expert Medial Opinion

Things to consider

- What would the financial impact be if you or a loved one were seriously ill?

- Will your spouse take unpaid leave from work to care for the family while you are unable to?

- Will there be necessary medication and treatment not covered by Provincial programs?

- Would you choose to have family at your side during your treatment?

- What will the impact be around the house?

- Will you take a well-deserved vacation to celebrate your recovery?

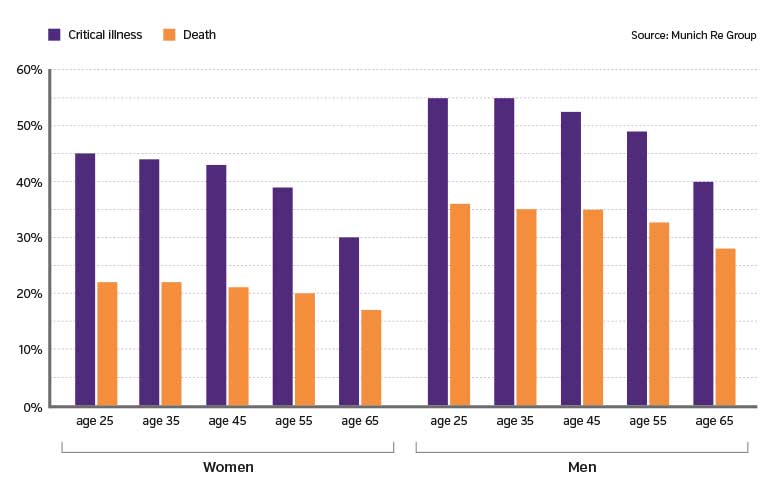

Probability of having a critical illness before age 75 versus the likelihood of death